Knight Frank Alpine Index 2025: How the World’s Jet-Set Elevate Their Winter Havens.

As the snow-dusted chalets of Europe’s most coveted ski resorts bask in the glow of another stellar year, the latest Knight Frank Alpine Index delivers a dazzling snapshot of high-altitude luxury real estate in 2024. The verdict? Prime Alpine properties remain the ultimate trophy asset, defying economic turbulence with their timeless allure.

Courchevel Takes the Crown—But the Swiss Play the Long Game

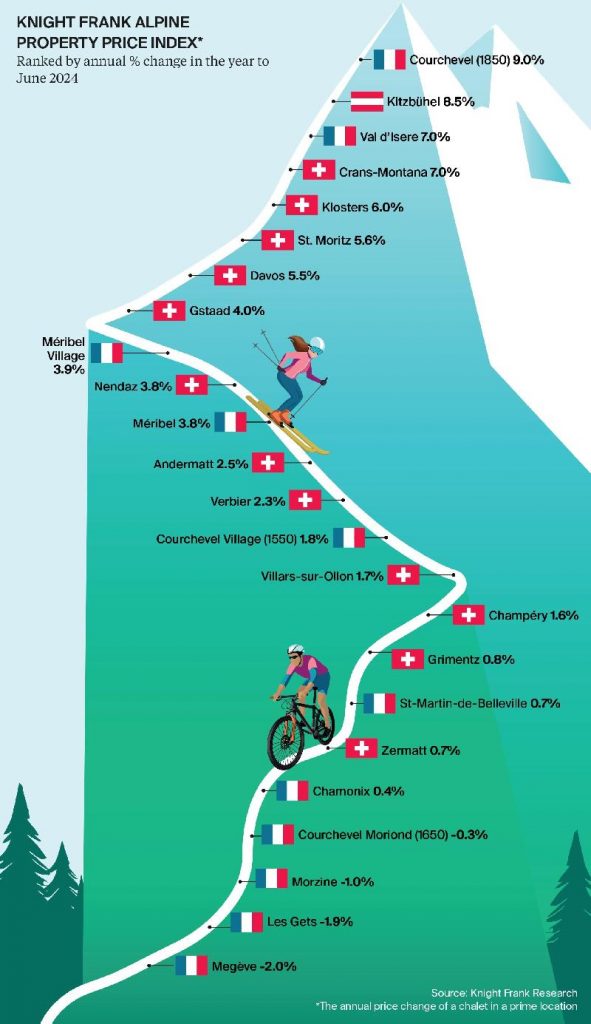

Leading the pack, Courchevel 1850 sparkled with a 9% price surge, driven by a painfully tight inventory. Yet, while this French gem claimed the year’s top spot, Switzerland once again proved its chops as the discerning investor’s playground. Across 12 key Swiss resorts, prices rose an average of 3.5%, handily outpacing France’s 1.5% uptick. A timely rate cut by the Swiss National Bank in March added fuel to the fire, solidifying Switzerland’s reputation as a haven for stable returns and tax advantages.

Gstaad and St. Moritz: Where Luxury and Exclusivity Converge

In Switzerland’s elite enclaves, the competition was fierce. Gstaad retained its ultra-luxurious cachet, hitting €41,500 per square meter with a 4% annual price bump, while St. Moritz—the jet-set darling—saw values climb 5.6% to €33,250 per square meter. Both markets owe their meteoric rise to a potent blend of limited supply, unmatched winter amenities, and the enduring charm of Swiss precision.

France’s Dual Appeal: Prestige Meets Accessibility

For those who dream of fresh croissants and pristine pistes, Val d’Isère came in hot with a 7% price increase, driven by the demand for ski-in/ski-out properties. Courchevel 1850, however, remains the jewel in the French Alps’ crown, with prices at €31,600 per square meter. France continues to captivate a broad spectrum of buyers, blending top-tier prestige with infrastructure that caters to both the discerning elite and the adventurous families.

Austria: The Quiet Achiever

Meanwhile, Austria’s Kitzbühel demonstrated it’s not just a pretty face, with an impressive 8.5% price growth. Offering a more accessible entry point for affluent buyers, its charming villages and modern connectivity make it a favorite for those seeking understated luxury.

Resilience, Reinvention, and the Road Ahead

From 2009 onward, the Alpine property market has proven as resilient as its snow-capped peaks, growing an average of 1.9% annually over 13 years. Post-pandemic, this pace has quickened, with 2024 showing a robust 3% average rise. However, the market isn’t without its challenges. Shifting debt dynamics, evolving climate considerations, and economic headwinds are prompting a new kind of buyer—one who prizes sustainability as much as ski-in glamour.

The Takeaway for the Elite Investor

For the affluent clientele eyeing a slice of Alpine heaven, the message is clear: these markets are no longer just winter wonderlands—they’re investment fortresses. Whether it’s the exclusivity of Gstaad, the prestige of Courchevel, or the understated charm of Kitzbühel, the Alpine property market continues to deliver a heady blend of lifestyle and lasting value.

So, the question remains—will you carve your niche on these gilded slopes, or be left out in the cold?