The Digital IQ Index: China

While Mainland China’s organic luxury sales growth softened to single digits, Chinese tourist spend abroad increased 58 percent in Q3 2012, suggesting consumer demand remains robust, according to the latest “Digital IQ Index: China” research released by L2 think tank.

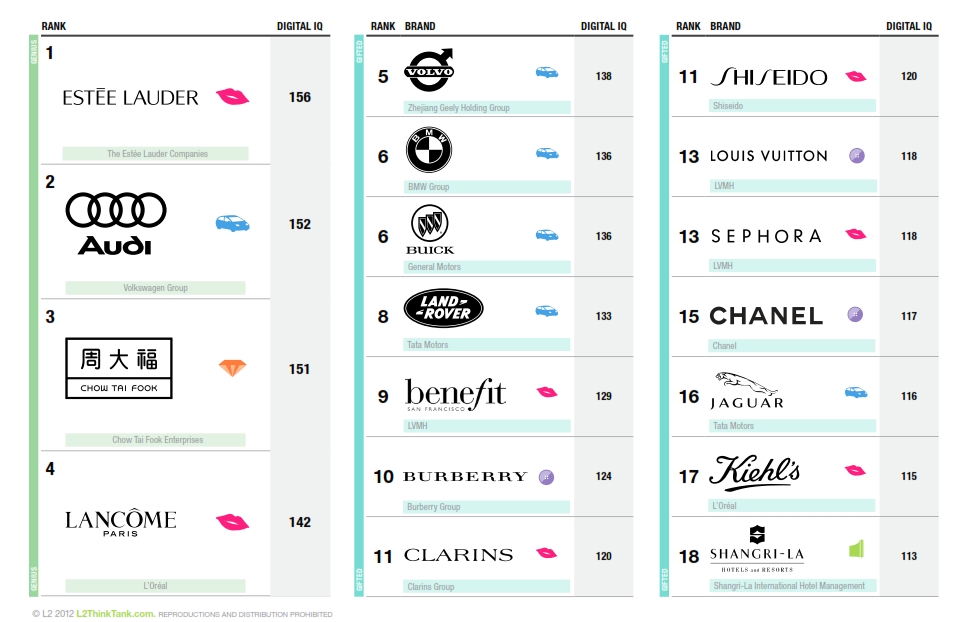

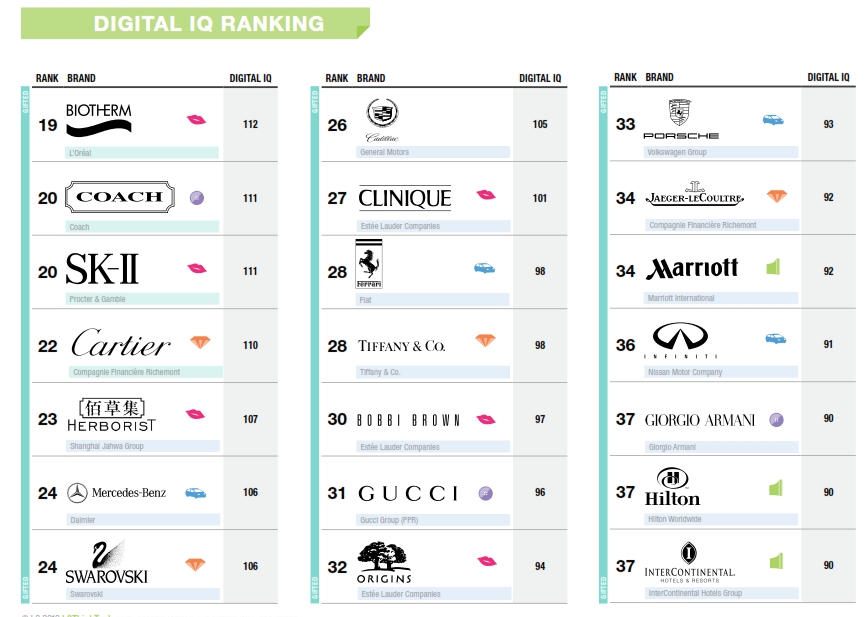

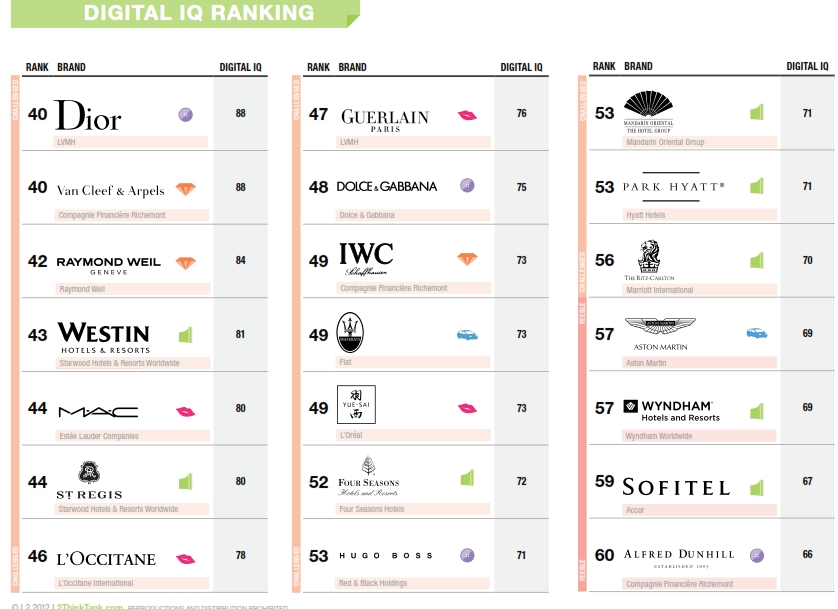

The Digital IQ Index: China ranks the digital competence of 100 prestige brands, evaluated on more than 800 data points across four dimensions: 30% Site (localization of site features, customer service & store locator, product page, e-commerce & checkout, integration of Chinese Social Media, Innovation in product customization, BBA/Microsites, category-specific functionality), 20% Digital Marketing (search, digital media and email marketing efforts), 30% Social Media (brand presence, community size, content and engagement), and 20% Mobile (compatibility, optimization, mobile site, android applications, iOS applications, and marketing on smartphones and tablets).

“Amidst slowing growth and political uncertainty, luxury executives are questioning whether the deceleration is temporary or the beginning of the end. We continue to believe China offers more upside, often linked to digital, than any other luxury market. However, there is also more complexity and barriers to realizing return,” says the authors of the study.

Estee Lauder, Audi, Chow Tai Fook Jewellery, and Lancome were able to accumulate points to successfully fit the “genius” category.

2012 Digital IQ Index: China – top 10 ranking:

1. Estee Lauder – L2’s digital IQ index: Genius

2. Audi – L2’s digital IQ index: Genius

3. Chow Tai Fook Jewellery- L2’s digital IQ index: Genius

4. Lancome – L2’s digital IQ index: Genius

5. Volvo – L2’s digital IQ index: Gifted

6. BMW – L2’s digital IQ index: Gifted

6. Buick – L2’s digital IQ index: Gifted

8. Land Rover – L2’s digital IQ index: Gifted

9. Benefit – L2’s digital IQ index: Gifted

10. Burberry – L2’s digital IQ index: Gifted

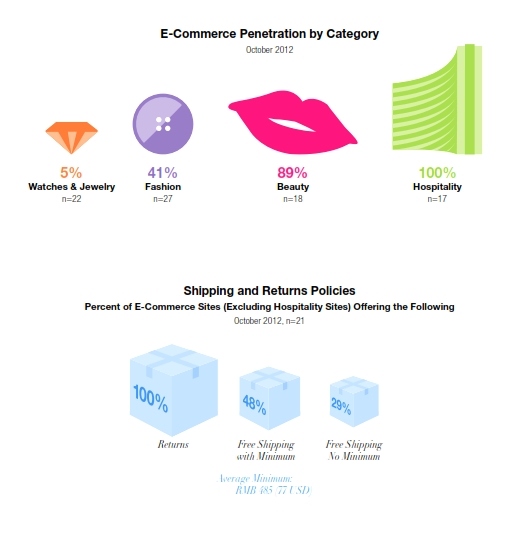

In the next years, Chinese e-commerce sales are projected to triple, says L2. However, two thirds of online sales will remain on C2C channels such as Taobao. Poor fulfillment infrastructure, security concerns, and nascent payment systems pose challenges to traditional direct e-commerce businesses.

61 percent of Chinese high-net-worth individuals indicate the Internet is a primary source for brand information, more than any other channel. However, while digital, social media, and video platforms may be the best places to reach Chinese consumers, the landscape is fragmented, with players emerging and declining in importance each year.