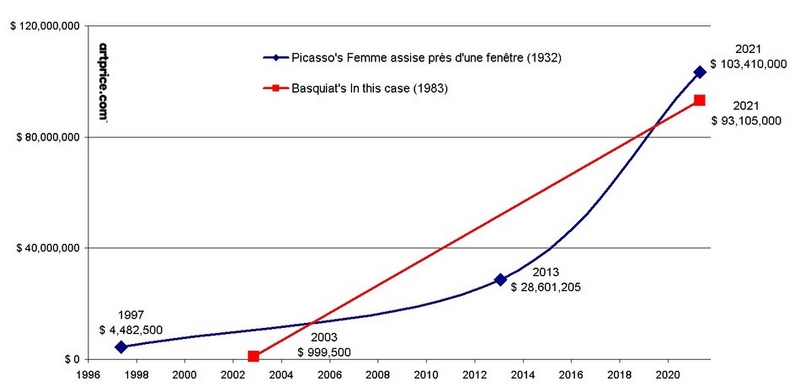

Real paintings by blue-chip artists remain the super-stars of the art market, says Artprice, the world’s leader in art information. The May activity clearly signals a return to pre-pandemic dynamism.

The art market seemed to have forgotten its past and all of its reference points after the online sale of Beeple’s NFT

Everydays (which sold for $69 million at the beginning of March). But the major New York spring sales showed that blue-chip artists (Picasso, Basquiat, Monet, Warhol, etc.) remain the real pillars of the international art market.

Artprice reminds us that the fundamental principles underpinning the price levels of artists and artworks are still very much alive and relevant in 2021.

“The Art Market’s switch to digital – which substantially accelerated a little over a year ago – has not shaken the foundations on which this market has been developing for three decades. Its stable and rational structure quickly re-emerged as soon as Western countries began to emerge from the health crisis.” – Thierry Ehrmann, President and Founder of Artmarket.com and of its Artprice department.

Art Sales in May, 2021: Over $1 billion in three days

Whereas London’s sales were postponed by several weeks and were partly weakened by the implementation of

Brexit, New York’s prestige sales were the first major art market rendezvous for over a year. This unique concentration of Modern, Post-War and Contemporary masterpieces, all offered in just a couple of days, rapidly reassured the market and its followers. The first lot hammered by Christie’s on 11 May, Night Vision by Alex da

Corte (1980), doubled its estimate to reach $187,500.

Demand is both strong and selective

Christie’s and Sotheby’s both offered – just two days apart – canvases by Gerhard Richter, both titled Abstraktes

Bild and both dated 1992, and almost of the same dimensions. The first sold for just under $7 million (below

Christie’s $9-12 million estimate) while the second, from the collection of Mrs. John L. Marion, reached $23.3

million at Sotheby’s.

The substantial price differential between these two works, which have very similar technical characteristics, is

extremely reassuring to Artprice, which sees it as an indication that demand is strong but attentive to the intrinsic quality of each piece as well as to their origin; a demand that is capable of adjusting its intensity and defying estimates.

Top 10 price hikes in New York Art Auctions (11-14 May 2021), according to Artprice.com;

- Salman Toor, The Arrival (2019): $867,000 (est. $60,000 – $80,000);

- Lynda Benglis, Knot / Hat B (1993): $201,600 (est. $15,000 – $25,000);

- Hernan Bas, Loving Nobly (2004): $94,500: (est. $9,000 – $12,000);

- James Ensor, Untitled (1888): $143,750 (est. $15,000 – $20,000);

- Rashid Johnson, Anxious Red Painting (2020): $1,950,000 (est. $200,000 – $300,000);

- Frank Stella, Polar Co-Ordinates III (1980): $47,880 ( est. $6,000 – $8,000);

- Alexander Calder, Le Buveur d’Eau (1967): $378,000 (est. $ 50,000 – $70,000);

- Dana Schutz, The Fishermen (2021): $2,970,000 (est. $400,000 – $600,000);

- David Hockney, Home-Made Prints (1986): $963,800 (est. $150,000 – $200,000);

- Kees Van Dongen, Robert de Saint-Loup (1946-47): $143,750 (est. $20,000- $30,000).

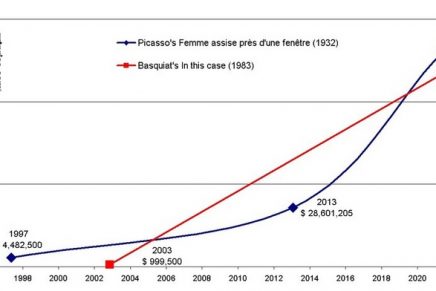

Top 10 artists by auction turnover (1 January 2021 – 15 May 2021), according to Artprice.com

1. Pablo Picasso – $252,155,000;

2. Jean-Michel Basquiat – $217,287,000;

3. Claude Monet – $129,984,000;

4. Andy Warhol – $108,030,000;

5. Sandro Botticelli – $93,538,000;

6. Banksy – $83,540,000;

7. Beeple – $69,346,000;

8. Vincent Van Gogh – $63,253,000;

9. Zao Wou-Ki – $57,529,000;

10. Roy Lichtenstein – $55,613,000.