Chanel and Clinique are leading the way in luxury beauty: Euromonitor International.

Economy, Standard, Premium or Luxury? Brand Perceptions Around the World.

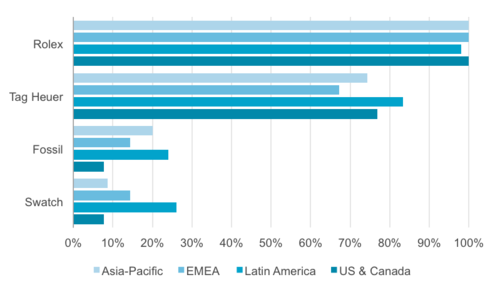

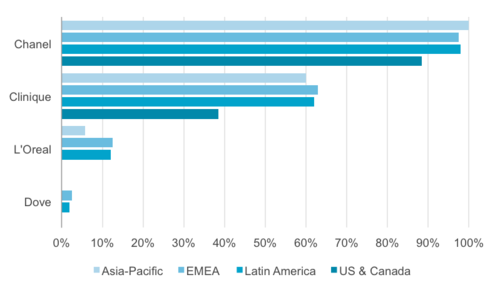

Different markets and regions have completely different perceptions of luxury brands. According to Euromonitor market researcher, the perception of brands as luxurious and trends in buying behaviours differ between developed and emerging markets and even between regions.

Euromonitor International’s global network of analysts to categorize selected brands of beauty products, timepieces, and apparel according to their local reputation, as well as the common occasions for which luxury goods might be purchased.

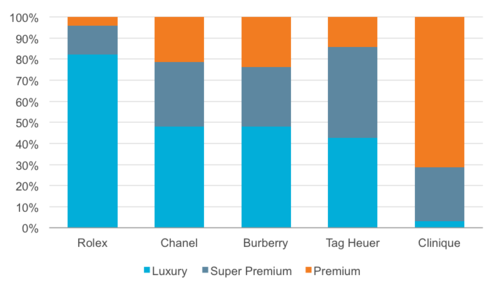

Across markets, almost all analysts rate Burberry, Rolex, Tag Heuer, Chanel, and Clinique brands as luxury or premium, rather than standard or economy. We then asked these analysts to provide additional detail on the perception of these brands as ‘premium,’

super premium,’ or ‘luxury.’ Rolex is perceived to be the most luxurious brand, with about 4 out of 5 analysts reporting it to be a luxury brand in their country. About half of the analysts report Chanel and Burberry to be luxury brands. Tag Heuer is balanced between luxury and super premium, while Clinique is largely perceived as a premium, rather than luxury, brand.

When buying luxury goods, consumers show different inclinations in their buying behaviours. Buyers in both developed and emerging markets appear to be cost-conscious with regard to luxury goods; however, this frugality translates to variations in typical buying behaviours.

Buyers in developed markets prefer affordable luxury products or luxury products that are highly discounted, such as during a flash sale or a limited time offer. These buyers are also more likely to purchase luxury products seasonally, perhaps around the holidays as gifts.

Alternatively, buyers in emerging markets prefer to buy luxury products abroad or at duty-free areas, where they often cost less than in their home countries. Cost-consciousness is also more likely to show itself via purchases of imitation luxury products in emerging markets. Here, the appearance of luxury sometimes matters more than an authentic luxury good or store experience.

In this truly global market for luxury goods, historically premium brands, such as Burberry, are competing with standard brands entering emerging markets. These brands may look into increasing their prices in emerging markets in order to maintain their “luxury” perception in relation to standard brands also entering the market. In contrast, premium brands in developed markets who wish to expand their customer base should focus on marketing themselves as a more-affordable option and can selectively increase their exposure by offering discounted products during seasonal buying sprees or flash sales. Simultaneously, higher prices and import duties are also feeding consumer trends of buying products abroad or in duty-free shops, and purchasing imitation products.

Detailed Perceptions of ‘Premium Luxury’ Brands

Perception of Timepiece Brands as ‘Luxury’ Goods

Perception of luxury – BEAUTY brands