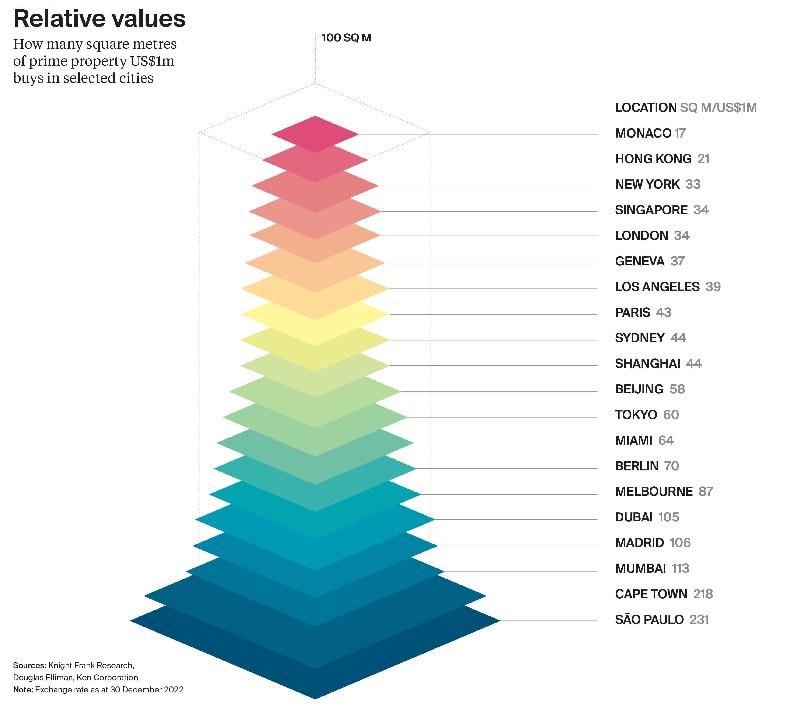

Knight Frank Wealth Report reviews how far US$1 million will stretch with prime residential property and asses how top end residential markets performed in 2022.

The Wealth Report offers an in depth analysis and the latest trends relating to global wealth.

“After the anomaly of 2021, 2022 was something of a transitional year. Some pandemic trends continued to play out, while mounting headwinds prompted some to reflect on their assets and investment strategies. In 2023, it is likely we will see this process of normalisation continue as transaction levels revert to pre-pandemic levels, down on the past two years but still highly active.” – Knight Frank Wealth Report.

Monaco holds on to its title as the most expensive residential market globally. However, in 2022, the strong currency rewarded the US dollar-based buyer with two extra square metres for their money compared with a year ago.

New York (33 sq m) has leapfrogged London (34 sq m), again due to the strength of the greenback, making it the third priciest city, although the two cities along with Singapore (34 sq m) are pretty evenly tied.

Dubai’s 44% annual price growth may conjure up notions of lofty prices, but values are rising from a low base. Here, US$1 million buys 105 sq m, five times as much space as in Hong Kong.

For real value, head to Cape Town or São Paulo where the same budget bestows more than 200 sq m.

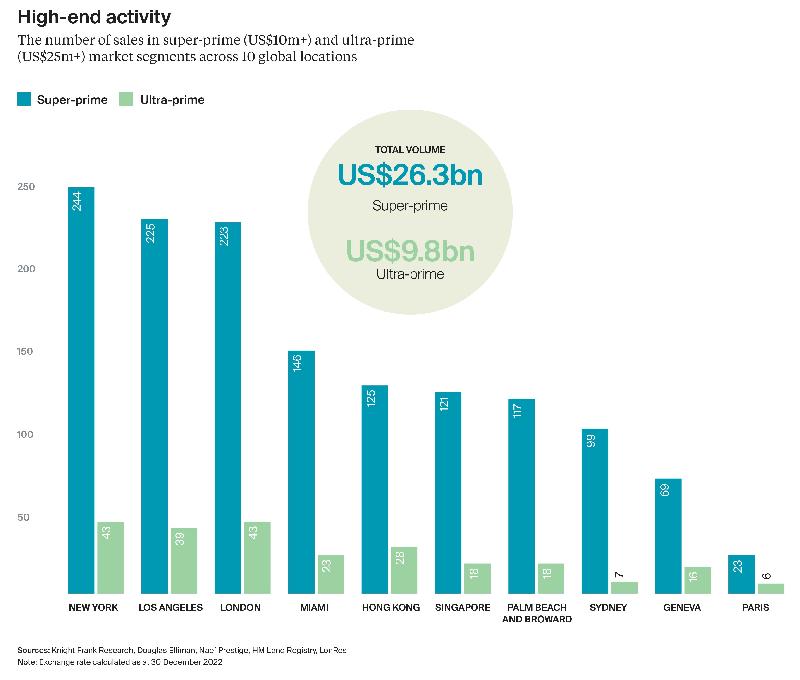

Activity at the top end of residential markets remained elevated from pre-pandemic levels in 2022 after a record-breaking 2021.

The pandemic-induced boom in prime, super-prime and ultra-prime markets globally continued into 2022. Some 1,392 sales were transacted at or above US$10 million across 10 global markets. While this represents a decline compared with the record-breaking 2,076 transactions recorded in 2021, it is still 49% above 2019 levels and equates to US$26.3 billion in sales.

New York retained its crown as the most active super-prime market with 244 sales of US$10 million or more. Los Angeles and London complete the top three with 225 and 223, respectively. The scale of activity in the US super-prime markets aligns with prime price growth in the PIRI 100.

As with many market segments, the second half of 2022 saw a slowdown in transactions as the cost of debt rose and talk of recession began to enter the daily vocabulary. However, the decline was moderate with 44% of transactions happening in the final six months.

Surprisingly, European cities were most resilient. Both Geneva and Paris saw their super-prime sales grow and London’s sales numbers dipped marginally with only two fewer than 2021. The UK capital, which shares the top spot with New York in the ultra-prime segment, recorded 43 sales of US$25 million or more – the highest level since 2014.