Bain Projects Global Luxury Goods Market Will Grow Overall by 10% in 2012, Though Major Structural Shifts in Market Emerge

Strong Holiday Sales Will Cap Off Strong Performance in 2012

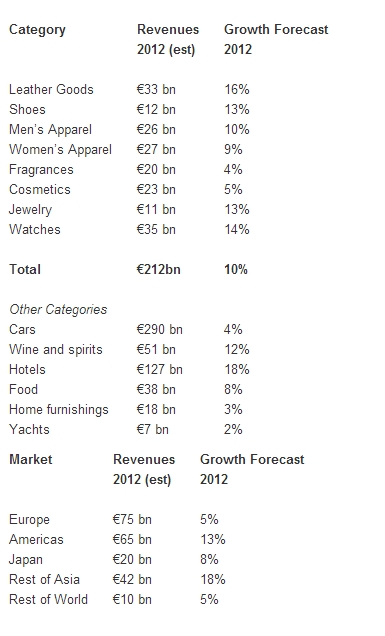

Worldwide luxury goods market revenues will grow by seven percent in the final three months of 2012 versus the same period in 2011, culminating in full year growth in 2012 to 10 percent, and pushing total luxury goods revenues to an estimated €212 billion; according to Bain & Company’s 11th Edition of “Luxury Goods Worldwide Market Study.”

The 10 percent increase estimated for the market in 2012 represents the third straight year following the “great recession” that luxury goods revenues will grow annually by double-digits. Asia-Pacific sales, driven by China, are projected to grow by 18 percent, while the Americas region is also projected to post strong gains, with revenues rising by 13 percent by year’s end. Growth in Europe will approximately halve versus last year, expected to grow by 5 percent this year. Bain estimates that the luxury goods market will grow, in real terms (i.e. using constant exchange rates) by four to six percent per year between 2013 and 2015, pushing the market to between €240 and €250 billion by the middle of the decade.

“Concerns about market weakness are somewhat overblown,” said Claudia D’Arpizio, a Bain partner in Milan and lead author of the study. “But we are seeing sharp disparities between brands that are not keeping up with the quickening pace of change in the market and those that are adjusting to shifts in tastes and demographics.”

Fundamentals for growth remain strong, but it’s going to be a bumpy ride,” concluded D’Arpizio. “The strategies that brands relied on to win in the past simply aren’t going to connect with the segments that will matter most in the second half of the decade.”

While overall growth in revenues finds its new level, however, the nature of that growth is shifting substantially in several key ways.

- Chinese consumers have further transformed the luxury market, with growth in domestic sales and continued voracious spending as tourists. Greater China has bypassed Japan as the sector’s second market, behind the United States. Chinese consumers now make half of the luxury purchases in all of Asia, and nearly one third of those in Europe. Globally, one in four purchases of personal luxury goods comes from Chinese consumers.

- E-commerce is continuing to grow at 25 percent growth a year, while sales at off-price (i.e., discount) outlets will see 30 percent growth. Together, these emerging channels amount to €20 billion, effectively the equivalent of sales in Japan.

- The study finds a generational shift under way as young consumers seek significantly different experiences from luxury consumption, seeking uniqueness over heritage, 24/7 access over exclusivity, and entertainment over mere shopping.

- Accessories have become the core category in personal luxury goods. For the first time, leather goods and shoes have become the largest piece of the market, now at 27 percent of sales. The category is seeing increasing levels of male spending, and increasing interest in higher quality, higher price items.

- Tourists now account for 40 percent of global luxury spending. As tourism and luxury spending become more tightly intertwined, the experiential dimension of luxury consumption becomes as critical for brands to deliver as their products.