United Stated has suspended plans to impose tariffs of 25 percent on French high-end goods.

Trade War is over? The United States Won’t Tax French Luxury Goods by 25%.

The United Stated announced that it has suspended plans to impose tariffs of 25 percent on French luxury goods, due to take effect in response to France’s tax on big tech companies like Facebook and Amazon.

Last July, the Trump administration said it would impose 25 percent tariffs on some French goods but will delay collection of the levies. In response, France has adopted a 3 percent tax (Digital Services Tax (DST)) on the revenues some businesses focused on digital advertising and e-commerce. The measure had Facebook, Google, Amazon as targets.

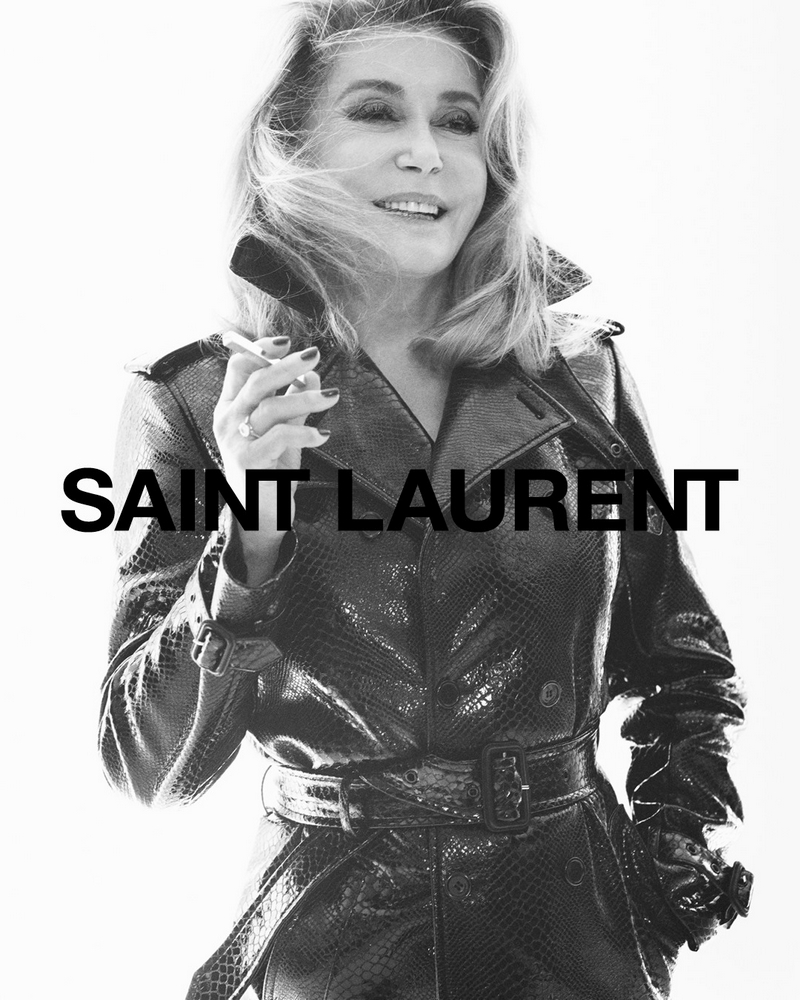

A list of imports from France worth $1.3 billion would have been subject to the additional 25 percent tariff. The list included beauty products like lip and eye makeup preparations as well as handbags with an “outer surface of reptile leather,” according to a statement on the US Trade Representative’s website posted in July 2020,” wrote businessoffashion.com.

“The U.S. Trade Representative has determined to suspend the tariff action in the Section 301 investigation of France’s Digital Services Tax (DST). The additional tariffs on certain products of France were announced in July 2020, and were scheduled to go into effect on January 6, 2021. The U.S. Trade Representative has decided to suspend the tariffs in light of the ongoing investigation of similar DSTs adopted or under consideration in ten other jurisdictions. Those investigations have significantly progressed, but have not yet reached a determination on possible trade actions. A suspension of the tariff action in the France DST investigation will promote a coordinated response in all of the ongoing DST investigations.” said the Office of the United States Trade Representative in a statement.

The U.S. Trade Representative has also issued findings in investigations of Digital Service Taxes (DSTs) adopted by India, Italy, and Turkey, concluding that each of the DSTs discriminates against U.S. companies, is inconsistent with prevailing principles of international taxation, and burden or restricts U.S. commerce.

USTR said in the statement that it is not taking any specific actions in connection with the findings at this time but will continue to evaluate all available options.

The investigations of the DSTs adopted by India, Italy, and Turkey were initiated in June 2020, along with investigations of DSTs adopted or under consideration by Austria, Brazil, the Czech Republic, the European Union, Indonesia, Spain, and the United Kingdom. USTR expects to announce the progress or completion of additional DST investigations in the near future.