Apple Regains World’s Most Valuable Brand Status.

Apple sits on top of the Kantar BrandZ Most Valuable Global Brands 2022 ranking and is on track to become the first trillion-dollar brand. With a brand value of $947.1bn, Apple stands out for its high degree of differentiation and continued diversification across its hardware, software and services portfolio. Google moves up to second place and is one of the fastest risers in the ranking, increasing its brand value by 79% to $819.6bn. Google’s suite of work and productivity apps have made it an essential part of consumers’ lives worldwide.

The combined value of the world’s Top 100 most valuable brands has increased by 23% to $8.7 trillion over the past year, highlighting the importance of brand strength in navigating an unsettled global economy.

Thirty-seven brands improved their ranking this year. In 2022, over three quarters of brand value originated from US companies. Media & Entertainment, Business Solutions & Technology Providers and Retail categories account for over half of the total value of the Top 100 ranking.

Kantar BrandZ Top 10 Most Valuable Global Brands 2022:

1. Apple (US)

2. Google (US)

3. Amazon (US)

4. Microsoft (US)

5. Tencent (China)

6. McDonald’s (US)

7. Visa (US)

8. Facebook (US)

9. Alibaba (China)

10. Louis Vuitton (France).

Key trends highlighted in Kantar BrandZ’s global study include:

MICROSOFT, ZARA AND IBM lead the way in the new Kantar Sustainability BrandZ Index, which shows sustainability already accounts for 3% of brand equity and is expected to rise.

TESLA is one of this year’s biggest success stories shifting to No.29 from No.47 mirroring the world-wide sales trend of electric vehicles more than doubling in 2021.

LOUIS VUITTON (No.10; $124.3bn) is the first luxury brand to reach the global Top 10 reflecting the growth of the luxury market worldwide and in China in particular. Louis Vuitton experienced 64% growth in brand value this year and is the first European brand to reach the global Top 10 since 2010.

NEWCOMERS in 2022’s ranking emerge from a range of categories. Aramco, one of the world’s largest integrated energy and chemicals companies debuted highest at No.16. India’s IT services and consultancy Infosys arrived at No.64. Latin America’s largest online commerce and payments ecosystem, Mercado Libre entered at No.71.

CHINESE brands hold strong, despite facing unique pandemic challenges, placing twice in the global Top 10 with Tencent at No.5 and Alibaba at No.9. China is also the only market rivalling the USA’s dominance in the Media & Entertainment category with WeChat at No.5 and TikTok at No.9.

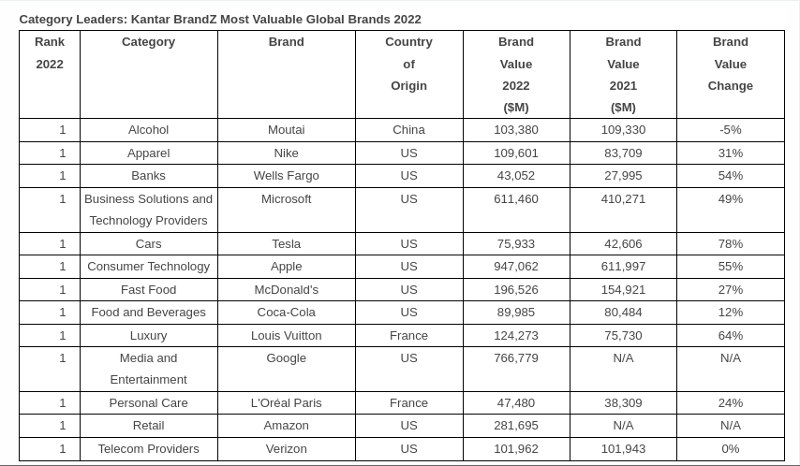

Sector leaders come from a mix of industry sectors

Technology and Luxury brands grew the fastest; 46% for Consumer Technology and 45% for Luxury. Bank and Automotive brands also demonstrated impressive growth; Automotive by 34% and Banks by +30%. This compares to growth across sectors such as Apparel (20%) and Personal Care (17%). At a category level, Wells Fargo was the only new No.1 brand, moving from second to first place in the Banking category and replacing China’s ICBC.

Category Leaders: Kantar BrandZ Most Valuable Global Brands 2022

“’Strong brand affinity underpins a customer’s willingness to pay and has never been more important for organisations looking to offset spiking inflation,” explains Martin Guerrieria, Head of Kantar BrandZ. “This year’s results show us the value of continued investment in brand and marketing capabilities, as a means of maximising business returns, irrespective of market conditions.”

Focus on brand-building, product and market diversification maximises business returns:

The pandemic has further accelerated growth of e-commerce in the retail category, hence brands with stronger connections to consumers were able to sustain their growth online and beyond.

Portfolio brands that continue to innovate and diversify their offer continue to grow, especially evident with Apple, Google and Amazon, amongst others, as their services cross technology, entertainment and payment services. Brands reliant on one category or market have the greatest risk profile, whereas brands that have diversified into multiple categories and markets showed faster brand value growth in 2022 and have a better chance of above-average growth.

To navigate a disruptive market, brands must lock down trust as a means of driving stability and safety. More than in the past, brands today must build trust on the basis of societal performance, not just product performance. Sometimes, this means a social purpose that is integrated into the entire organisation. Nike is a good example with its ongoing commitment to inspire and innovate for everyone, not just high-performance athletes, particularly girls and minority communities.

“Kantar BrandZ’s 2022 global report, the 17th edition, uncovers the importance of brand-building to help survive market disruption, continues Guerrieria. Brands are typically the biggest assets businesses have, adding massive value to the balance sheet. In uncertain times, management decisions on marketing investment can be supported by proven metrics. Kantar BrandZ’s brand valuations clearly show how great marketing connects to brand value in both the short and long-term.”