With 45% of shares of sales, the US art market retains its leading position. Report.

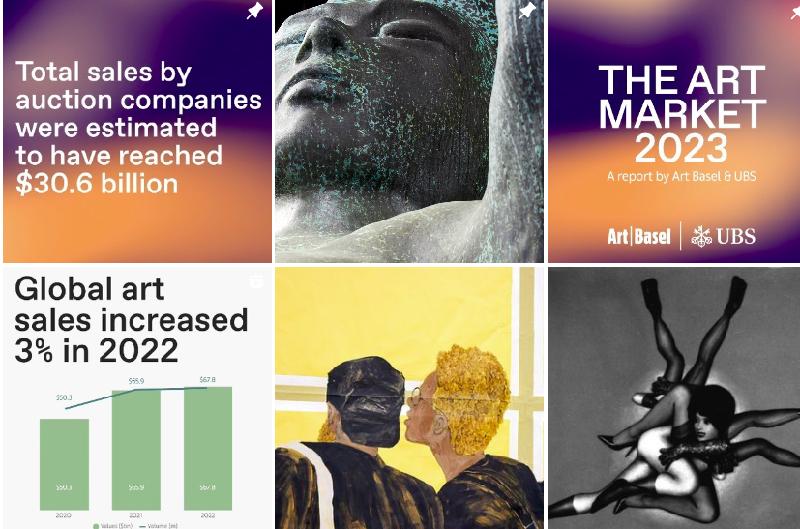

Inflationary pressures, the long tail of the COVID-19 pandemic, supply chain issues, and cryptocurrency turbulence: the art market has been subject to manifold, and at times contradictory forces over the last year. The sixth edition of Art Basel‘s landmark report, The Art Market 2023, authored by Dr. Clare McAndrew, Founder of Arts Economics and published in partnership with UBS aims to decode this territory. In an ever more quantified, yet also ever more complex world, the merits of data-driven analytics in supplying transparency in the art market is paramount, and this latest report provides a clear view on how the art industry has fared.

The Art Market 2023 presents the findings of research on the global art and antiques market in 2022. The information presented in the report is based on data gathered and analyzed by Arts Economics (artseconomics.com) from dealers, auction houses, collectors, art fairs, art and financial databases, industry experts, and others involved in the art trade.

“The art market as a whole expanded, despite the volatility in the wider economy. A closer look, however, reveals a mixed picture: while the larger dealer segments grew, sales for the smallest dealers, and many parts of the auction market contracted. Overall, the market grew by 3%, driven by a 7% increase year-on-year in dealer sales, restoring the market to its value before the pandemic in 2019 for that sector. This was catalyzed by the event-driven cycle of art fairs, gallery openings, and auctions resuming its customary rhythm” – Noah Horowitz, CEO Art Basel.

Despite the crypto winter, the popularity of digital, film, and video art increased substantially, from 1% of dealer sales in 2021 to 5% last year. NFT-backed digital art accounted for much of that change, indicating how the market continues to evolve and adapt to the times

High-net-worth art collectors – surveyed last year by Arts Economics in collaboration with UBS Investor Watch – remain optimistic about the market, spending more in 2022 than they had prior to the pandemic, and looking positively into 2023, with strong spending plans – 77% expected the market to grow, and the majority intended to purchase art in 2023. So, while signals of macro-economic volatility are a dominant talking point as we head into 2023, the data shows us a resilient art market bolstered by deep-pocketed collectors, particularly at the high end.

Here are the key findings:

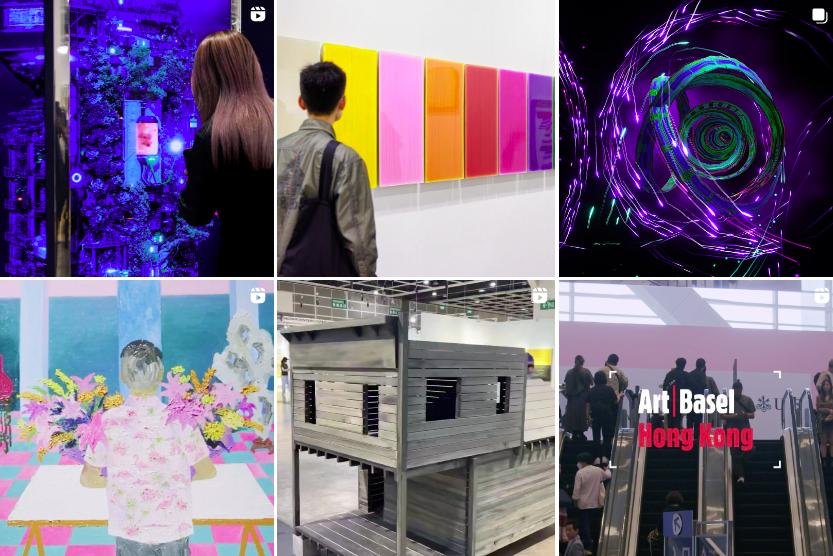

- The global art market grew by 3% year-on-year to $67.8 billion, exceeding its pre-pandemic level in 2019. However, growth was more subdued in 2022 due to variations in performance by sector, region, and price segments.

- The number of art transactions increased by only 1% in 2022 to 37.8 million, with dealers accounting for most of the rise. This is a slower increase than the previous year’s 19% rise.

- Sales in the high-end art market continued to drive growth, with the public auction sector seeing a slight decrease of 1% to $26.8 billion, while works priced at over $10 million increased in value. The dealer sector grew by 7% to $37.2 billion, with higher-end sales outperforming lower tiers.

- The US remained the largest art market with a 45% share of sales by value, followed by the UK at 18%. China’s share decreased to 17%, and France maintained its position as the fourth-largest art market with a 7% share.

- After a significant decline in sales during the pandemic, the US art market has seen one of the most robust recoveries of all the major markets. From a pandemic-induced low in 2020, sales bounced back in 2021, increasing by just over one third in value to $28.0 billion. Growth continued in 2022 with a further increase of 8% year-on-year to $30.2 billion, its highest level to date. This was driven by a major uplift at the high end of the auction sector, along with more moderate but positive growth in dealer sales.

- Despite a year of intense economic and political pressures, sales in the UK maintained their momentum, with a rise of 5% to $11.9 billion in 2022. This second year of growth boosted the market from its 2020 low, although sales were still below their prepandemic level in 2019 of $12.2 billion.

- China had a significantly worse year in 2022, with lockdowns stalling activity, and sales and events curtailed or cancelled. Sales declined by 14% year-on-year to $11.2 billion, and although still 13% above 2020, this was their lowest level prior to that since 2009.

- The French art market saw positive, low growth of 4% year-on-year measured in US dollars, with the increase somewhat muted by deteriorating Euro values in 2022. Following a drop in value of 30% in 2020, sales in France had a particularly strong uplift in 2021, increasing by 58% year-on-year to $4.8 billion. The continued growth in 2022 led to a new peak of just under $5 billion, the highest level to date.

- As exhibitions, auctions, and art fairs all ran on much fuller schedules and collectors began to reengage with live events and sales, both dealers and auction houses reported a further reduction in their share of e-commerce in 2022. Online-only art sales fell to $11.0 billion, a decline of 17% from the 2021 peak of $13.3 billion, but still 85% higher than in 2019. Online sales accounted for 16% of the total value of the art market’s 2022 turnover,down from the peak of 25% in 2020, and 4% lower than the share of global retail e-commerce (20%) in 2022.

- After reaching a peak in late 2021 of close to $2.9 billion, sales of art-related NFTs on platforms outside the art market fell to just under $1.5 billion, a decline of 49% year-onyear. Despite the significant drop in value, sales were still over 70 times those in 2020 (at just over $20 million). The decline in value was much greater for art-related NFTs than other segments, and they accounted for just 8% of the value of NFT sales on the Ethereum network in 2022 (versus 67% for collectibles-based NFTs).